Energy Innovation Basecamp - Problem Statements 2024

We asked GB's Electricity and Gas Networks to share some of the specific, technical challenges they are facing, both in the short-term and as we progress through the Energy System Transition. Here, you can learn more about these network challenges and how you can get involved in this year's Basecamp Process.

Pick a theme below to anchor to correct section of page:

- Building Better and Faster

- Decarbonising Network Operations

- Flexibility and Forecasting

- Maximising Use of Existing Infrastructure

- Net Zero Transition Impacts

- The Consumer Journey to Net Zero

Application is now closed. The basecamp timeline of events here. Agenda for the Basecamp launch event can be viewed here.

Building Better and Faster

Modernising the design of planning, procurement and construction projects to deliver better, faster and more innovatively.

What is the problem?

DNO connection application process, especially on the HV and EHV levels can take substantial amount of time and involve various teams across the DNO business (i.e. connections, primary network design, engineering design, wayleaves, etc). In an attempt to introduce time efficiency savings, we would like to explore a feasibility of using AI to streamline an application process. This would begin with determining if an AI could correctly assess the category of application to ensure it was routed to the correct team. It could also include using AI to sense check the values on the application form to identify potential errors. This may also be useful to transmission connections and it would be useful to know if the same techniques could apply for different types of network.

What are we looking for?

How can we use AI to review a customer’s connection application, suggest relevant connection offer types and then produce the connection offers? Can AI be used to identify key information on an application that is missing or likely to be incorrect and therefore speed up the resolution process? What algorithms and most importantly minimum amount of data and data quality is required to generate a connection offer on HV and EHV level. How can we establish and track a confidence level of the accuracy of an AI-generated offer? Can AI be used to carry out power system studies?

What are the constraints?

Understanding of the data requirements for AI-performed power system studies. Understanding the minimum data requirements and quality of the data to categorise connection requests.

Who are the key players?

DNOs, DNOs customers and consultants.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

Previous projects in this area include;

- NIA2_NGESO060 FastOut - https://smarter.energynetworks.org/projects/nia2_ngeso060/

- NIA2_NGESO061 voltaVisor - https://smarter.energynetworks.org/projects/nia2_ngeso061/

- NIA2_NGESO08 InterCast - https://smarter.energynetworks.org/projects/nia2_ngeso058/

Relevant policy information can be found here: The future of the ESO and Artificial Intelligence | ESO (nationalgrideso.com)

Download full document here

View presentation slide here

View presentation video here

What is the problem?

The Nick Winser Report Recommended (Page 26: Electricity Networks Commissioner –Companion Report Findings and Recommendations):

AR1: An automated corridor routing process should be adopted as standard practice. This will allow more corridor routing options to be considered than is possible without automation. A landscape architect would oversee the automated process and use the output to make a final decision on the corridor route. Regulatory and Planning approval processes will need to recognise and accept the use of this approach and supporting tools.

AR2: A route design process that uses the Electricity Transmission Design Principles (ETDP) should be adopted. A new tool should be developed that supports this process by supporting design of the location within the corridor route and selection of the type of asset (e.g., overhead line, tower, cable etc) that should be used. A design engineer would oversee the automated process and use the output to make a final decision on the proposed route design. Regulatory and Planning approval processes will need to recognise and accept the use of this approach and supporting tools.

The identification of corridor routes during the design stage can take time and resource as multiple options need to be investigated and many data sources interpreted to find the most suitable corridor routes. thereby adding time and cost to projects.

A consistent methodology and toolset across networks could save time and increase confidence in the planning process.

The current situation:

- There is no consistent method across networks for route planning

- Planners and stakeholder groups lack confidence in the plan being optimal

- Reworking of plans and routes causes delay in consenting

- Standardised tools allow integration of planning across TO & DNO boundaries.

We also include within these challenge ideas related to data and digitalisation of planning and consenting process. This is a more complicated problem as it includes government and local authorities.

What are we looking for?

We are looking for tool(s) and method(s) that will facilitate:

- An automated corridor routing process

- A route design process that used the ETDP

- Incorporate the latest data science such as AI to assist and speed up route planning

- Data and digitalisation of planning and consenting process.

We anticipate that the initial work packages will:

- Survey networks on current practice

- Undertake a literature review and market survey to establish state-of-art in route finding and route optimisation.

We anticipate future work packages will:

- Engage with the ETDP when created

- Form a working group/forum to create a Statement-of-Requirements (SOR) for tool(s)

- Develop the solution(s), possibly with a consortium of innovators.

What are the constraints?

The ESO (and FSO, when established) will convene a working group with the Transmission Owners, UK, Scottish and Welsh Governments, Ofgem and Energy Networks Association to progress a set of Electricity Transmission Design Principles (ETDP). Subject to consultation we will reference the new principles in future updates of the National Policy Statements, giving them status in the planning system. Transmission Owners may decide to start using the ETDP, once agreed, as the basis of engagement with communities ahead of full implementation via the National Policy Statements.

Who are the key players?

- All Electricity Transmission Networks

- Systems planners

- Data analytics team

- Project engineers

- The ESO/FSO

- Regulatory authority

- Regulatory planning bodies

- Welsh, Scottish and UK government

- Energy Networks Association

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

Download full document here

View presentation slide here

View presentation video here

What is the problem?

It takes multiple years for a 132 kV connection to go from application to energisation. At the site, substations’ works encounter hurdles such as obtaining planning permission for large areas of land, with lead times of around 2 years for transformers and difficulties with gas insulated switchgear leaks and emissions. Substation designs are usually bespoke with no set packages of equipment.

Concurrently, it is expected that significantly more connections at 132 kV will be required to meet net zero for generation, demand and mixed sites.

Can we alleviate the time, cost and planning of 132 kV connections with standardisation?

What are we looking for?

We are looking for a standardised, modular 132 kV substation design solution that can be applied to wide variety of use cases for 132 kV connections, through a small number of standardised variants. Consideration of firm vs non-firm variants would be welcome.

What are the constraints?

- The new solution must be competitive in terms of cost, time to install and/or footprint to traditional 132kV substations

- The solution must ensure that the DNO can comply with applicable legislation, licence conditions and network standards to ensure the safety of the public and network assets

- The solution must be agnostic or adaptable to import and export connections, including both at the same site

- The solution should be agnostic to the point of connection to the network

- The solution should avoid the use of SF6 gas as an insulating medium.

Who are the key players?

Key stakeholders are:

- Large connection developers

- Green investors

- Landholders

- Local authority planners

- Transformer and switchgear manufacturers and innovators

- Independent connection providers (ICPs)

- DNOs and IDNOs

The expectation that development will include customer engagement and research to identify the requirements for the solution and ensure that it is tailored towards these use cases. These customers will be the main beneficiaries, enabling them to connect the network more quickly, cheaply and/or with less land.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

Standardisation of substation is the norm at LV, following a transition from bespoke substations with separately chosen components.

The Take Charge NIA project developed a compact substation at 33/11kV for motorway service stations as a demonstrator of how standardisation can be approached at EHV.

What else do you need to know?

Innovators should be aware of DNO obligations to facilitate Competition in Connections when evaluating the business model for commercialisation of any eventual solution.

Download full document here

View presentation slide here

View presentation video here

What is the problem?

Recommendation SE1 of the Winser report: A forum should be created between the Future System Operator (FSO), Transmission Owners (TOs), equipment manufacturers and Ofgem to review and update equipment standards used within Great Britain.

The government agrees that greater coordination between the ESO and later the FSO (once established), Ofgem, TOs and equipment manufacturers on equipment standards would be beneficial. The Electricity Networks Association will establish a forum with key stakeholders, including TOs and equipment manufacturers, in partnership with Ofgem, to review decisions to ensure that any agreed standards are able to be accounted for when assessing the needs.

Implementation of updates to rationalise and align equipment standards recommended through the forum will require a process to scrutinise and assess proposed changes. This process will need to comply with existing and future grid codes and be approved by the ESO (and then FSO, when established). The TOs and the ESO/FSO will develop a process to implement equipment standardisation recommendations agreed at the forum. It is suggested that the existing code modification process is used as a starting point.

What are we looking for?

There is an opportunity to provide, tools, practices, designs and standards that result in a standard approach to network design in the UK.

We invite ideas for:

- Creating industry forums that allow standards to be agreed.

- Harmonisation of the digitalisation of designs

- New equipment design that allows plug-and-play methods of constructing, including offsite commissioning.

What are the constraints?

Innovators should consider how their idea(s) will complement the government's response to recommendation SE1 of the Winser Report.

Who are the key players?

- Networks

- Policy and standards

- Equipment manufacturers

- ESO/FSO

- Ofgem

- Grid codes

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

There are a number of projects that have investigated standardisation and modularisation of equipment. For example:

- The application of Parametric Design to automate substation development Determine the feasibility of applying Parametric Design to electricity substation design Define the design rules which can be applied as parametric rules Determine the input data required to facilitate the parametric design and efforts required to collect this Establish the overall feasibility (cost, benefit, time saved) of this approach for the design of the electricity substations (both new and modification of existing ones). The application of Parametric Design to automate substation development | ENA Innovation Portal (energynetworks.org)

- Modular Approach to Substation Construction – SSEN-T Design Development Identify the requirements and standards that govern transmission substations up to a voltage of 275kV and 400kV - however, it is anticipated that this will initially focus on 132kV designs; Modular Approach to Substation Construction - Design Development | ENA Innovation Portal (energynetworks.org)

- Substation Compaction A number of options for reducing the footprint of substations using conventional Air-Insulated Switchgear (AIS) have been identified. A compact AIS design would have advantages in applications where restrictions in the available land are encountered. For example, such a design might allow extension bays to be constructed within an existing substation boundary where space is restricted. Substation Compaction | ENA Innovation Portal (energynetworks.org)

- Modular Approach to Substation Construction (MASC SSEN-T SHE Transmission proposes to demonstrate and deploy a permanent substation designed using a Modular Approach to Substation Construction (MASC). The current approach to substation construction differs little from that of 60 years ago; meanwhile many innovations in design and civil engineering could create a substation which is cheaper, faster to deploy and more suited to GB’s low carbon energy future. MASC seeks to prove the following benefits: Modular Approach to Substation Construction (MASC) | ENA Innovation Portal (energynetworks.org)

- Future Intelligent Transmission Network SubStation (FITNESS) FITNESS will deliver the pilot GB live multi-vendor digital substation instrumentation system to protect, monitor and control the transmission network using digital communication over fibre to replace copper hardwiring, reducing cost, risk and environmental impact, and increasing flexibility, controllability and availability Future Intelligent Transmission NEtwork SubStation (FITNESS) | ENA Innovation Portal (energynetworks.org)

- Project CLoCC - Customer Low Cost Connections developed ‘off-the-shelf’ standardised designs for connections that can be used regardless of the customer, size of connection, or type of gas, to minimise the cost and time of new gas connections to the national transmission system (NTS). Project CLOCC | ENA Innovation Portal (energynetworks.org)

What else do you need to know?

A coordinated network approach that is aware of previous work Is required.

Download full document here

View presentation slide here

View presentation video here

What is the problem?

Historically, electricity networks have been designed and constructed as bespoke projects, each optimised for the requirements at a given location. When customers wish to connect to the network, and significant reinforcement or new assets are required, the range of options available is not easily understood and customers are required to wait for designs to be produced by network design engineers. In addition, customers may wish to opt for various levels of service and connection security.

What are we looking for?

We are looking for a way to streamline our range of products into standardised major project connection products, which customers can view and select online, integrated with BAU self-serve capabilities.

What are the constraints?

- The solution must allow a variety of OEMs to supply equipment to maintain diversity of plant.

- The new solutions must ensure DNOs can comply with applicable legislation, licence conditions, and network standards to ensure the safety to the public and network assets.

- The solution must integrate with existing self-serve tools and capabilities.

Who are the key players?

The key stakeholders are:

- Large connection developers

- DNOs and IDNOs

- Independent Connection Providers (ICPs)

- Transformer and switchgear manufacturers and innovators

- Local authorities and councils

- Website developers

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

The project builds on Northern Powergrid’s Strategic Innovation Funded project ‘Inform’ which is developing HV self-serve capabilities for larger sites and non-domestic properties. We would like to standardise the solutions selected by the tool into distinct products with the aim of improving clarity and lowering costs to customers.

What else do you need to know?

Innovators should be aware of DNO obligations to facilitate Competition in Connections when evaluating the business model for commercialisation of any eventual solution.

Download full document here

View presentation slide here

View presentation video here

What is the problem?

The consenting of new major infrastructure is a controversial and debated public topic. Objections to environmental impacts, including visual impact, are leading to objections to planning consent. Transmission towers and overhead lines have the largest visual impacts.

Generally, infrastructure is designed to a traditional lattice tower that has been established for many years. The visual impact of OHL lattice towers has not changed.

What are we looking for?

- New designs that reduce the visual impact of OHL lattice towers.

- Novel ideas that can help blend lattice towers into the landscape

- Tools that allow optimised routing that facilitates reduced visual impacts on local stakeholders. Please note we have a separate problem statement related to automated routing

- Any radical change to the design of the network that may reduce the impact on key stakeholders

- Reducing environmental impacts of new infrastructure using novel construction methods or materials.

What are the constraints?

Solutions must not degrade the performance and capacity of transmission lines. Solutions must be cost-comparable with existing designs.

Who are the key players?

- Networks

- ESO/FSO

- General public

- Local councils and planning officers

- Government

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

As far as we are aware, there are no solutions, other than camouflage painting, available on the market. SSEN-T have designed and are implementing low-profile poles for 132kV transmission: Low Profile 132kV Steel Poles | ENA Innovation Portal (energynetworks.org)

Download full document here

View presentation slide here

View presentation slide here

View presentation video here

Decarbonising Network Operations

Considering the requirements of net zero commitments in every stage of project lifecycles, to reduce the emissions associated with present and future network operations.

What is the problem?

SP Energy Networks, as a Distribution and Transmission Network Operator, keeps electricity flowing to homes and businesses throughout Central and Southern Scotland, North Wales, Merseyside, Cheshire and North Shropshire. Our number one priority is to keep the lights on for our customers and our critical operational service must be maintained and operated 24 hours a day, 365 days a year.

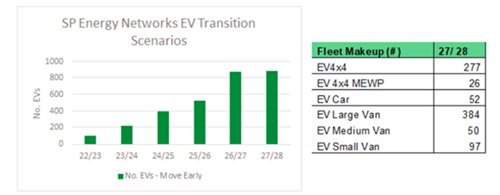

As a Distribution and Transmission Network Operator, we are central to the net zero transition, facilitating the decarbonisation of electricity, heat and transport. We have also set our own net zero target – and as part of this, we are decarbonising our vehicle fleet, transitioning between 800 and 900 cars, vans and utility vehicles from combustion engines to electric. The scale of the transition is shown below (note: likely to be updated early 2024).

Any transition to electric vehicles must not compromise on our number one priority of ‘keeping the lights on for our customers’. This is true under normal operational scenarios, but especially true in an event where we have catastrophic failures to the network (e.g. during a storm event). We must therefore ensure that we can safely undertake business as usual operations without significant disruptions and that we are agile enough to respond to catastrophic fault events as quickly as possible.

There have been internal concerns that we do not fully understand the risks of having a fully electric fleet and we are therefore looking to partner with suitable organisations who can help us understand:

- What are the risks to operations under business-as-usual scenarios?

- What are the risks to operations under catastrophic failures of the network? (e.g. extreme storm events, flooding, etc.)

- What measures can we implement to ensure that risks are mitigated?

What are we looking for?

Identification of Risks: We must be able to understand the risks associated with having a fully electric fleet under a business-as-usual scenario and multiple scenarios where there is a catastrophic failure of the network. Risks must be specific to Networks operators and developed by analysis of fleet operations, supported where possible from other companies who have similar operations. Risks should consider the type of work we do and the loads we transport. Risks should consider the vulnerability of the network and model scenarios where parts of the network are down, and vehicles are unable to charge.

Action Plan and Roadmap: We must be able to understand the practical actions we need to take to eliminate the risks identified above. Actions must be SMART and practical and should not include high level advice which cannot be actioned. Intangible actions will not be accepted as a satisfactory outcome of this project. Where internal action alone cannot fully alleviate the risk, we will need to understand specific external factors which need to change in order to support a fully electric fleet.

Example of SMART action: We have identified a lack of fast chargers in XXX region. SP Energy Networks must ensure that fast charges are installed in this region by 2025 so that staff can charge under BAU.

Example of an intangible action: SP Energy Networks should ensure that they work with Governments and car manufactures to drive wider change in the industry.

For this project, SP Energy Networks can provide:

- Telematics Data (See Appendix A for example)

- Details on Network vulnerability

- Resource from different departments / specialisms in SP Energy Networks for workshops / bilateral discussions and to feedback on questions as they arise.

What are the constraints?

N/A

Who are the key players?

Utilities, predominantly Electricity Distribution Network Operators would be the main stakeholders in this project and receive the most benefit.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

N/A

What else do you need to know?

Please provide a summary proposal of how you intend to fulfil the minimum requirements above. Proposals should outline the approach to tackling the questions above and give examples how this problem has been approached in other cases (giving examples of the final outcome where possible).

Please indicate costs as part of the proposal. Cost should be broken down where possible into core deliverables; and ‘optional extras’ if these can be added if these are fully costed.

Within the proposal, where possible, please identify requirements from SP Energy Networks (e.g., data required, need for SP Energy Networks to resource workshops, etc.)

Please also include an approximate timescale indicating availability for starting the project and timescales for completion.

Download full document here

What is the problem?

As the UK moves closer to the net zero 2050 target, various legislation and regulations are expected to be put in place requiring various industries, including energy networks to decarbonise their fleet and reduce emissions in construction activities. Construction activities can include materials, equipment, machinery & welfare cabins. Currently networks face the need to increase the number of zero emission vehicles within their operational fleet, specifically heavy fleet including over 3.5 tonne vans, grab lorries, vac ex etc. At present it is difficult to know what opportunities are out there and how best can the networks increase the percentage of zero/low emission vehicles.

What are we looking for?

Ideally, initial work will look to complete a high-level technology assessment on existing solutions for zero emission plant & vehicles, sustainable materials, tooling & equipment, creating options dependant on work type (CAPEX/REPEX/OPEX) and will provide a high-level roadmap for implementation and change from existing carbon intensive approaches.

Further assessment is required to identify and evaluate future funding/business incentives for achieving net zero construction through a sustainable approach.

It is anticipated that most solutions will be of a high TRL, with some evidence of previous success, however there is scope to fund lower TRL projects, if appropriate and eligible for network innovation funding.

What are the constraints?

Proposed solutions should be replicable across all networks (where applicable), with flexibility to adapt to individual organisation’s procurement requirements.

Solutions should be product or process focused and must be cost competitive against current practices where possible, to enable a valid cost benefit case for full implementation to be carried out.

Most networks currently deploy sustainable procurement practices, aiming to abide by key principles for reducing, reusing, and recycling to minimise carbon emissions, waste and harmful impacts on the environment.

Solutions must be deployable in line with existing sustainable procurement legislation.

Solutions may be eligible for innovation funding via Ofgem mechanisms (NIA/SIF), however higher TRL solutions may be evaluated/trialled for full implementation in the shorter term.

Who are the key players?

Energy Networks – Operations, Environment & Sustainability Teams, Procurement Teams, Strategy & Regulation.

Proposals are welcomed from all parties; however, it would be beneficial for solutions to be close to deployment/trial readiness to enable short term implementation plans to be developed.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

The problem statement utilises the assumption that electrical charging infrastructure, hydrogen and other low carbon refuelling stations remain a realistic option pre-2050.

Policy decisions will need to be considered, for example the ban of new sales for Internal Combustion Engine vehicles below 28 tonnes by 2035 and the over 28 tonnes by 2040.

This also includes the commitment to rollout 6,000 high powered EV charge points in the UK by 2035 and 300,000 public EV chargers by 2030. There are no official commitments by the UK government for Hydrogen refuelling stations, but the assumption can be made that they will be rolled out. Previous project such as NIA_NGN_420 provide evidence to suggest there is demand for Hydrogen for use in transport. The problem statement covers all current Network operations activities that are necessary today to meet our obligations as UK energy networks.

What else do you need to know?

Whilst this problem statement is formed in the strategic context of delivering net zero network infrastructure construction by 2050, it is also open to near term solutions which are rapidly deployable/scalable, in a cost-effective manner, to rapidly reduce carbon emissions of existing network construction methodologies.

Future gas & electricity network build out/repurposing to deliver net zero are expected to be highly carbon intensive from a plant & equipment perspective, but also from an embodied carbon perspective, therefore it is critical that all interested parties take a proactive approach to identifying, evaluating, investing in, and deploying at scale, low carbon, cost efficient construction initiatives.

Download full document here

View presentation slide here

View presentation video here

What is the problem?

The RIIO funding mechanism has enabled fast paced learning to be collated for the net-zero energy transition of the UK. Utilising this data will be a key aspect in ensuring any repurposing and new elements are well understood and commissioned. There is a risk that needs to be mitigated to prevent any significant delays and increase of cost to our consumer and take a pragmatic approach to the transition.

Today we use our Building Information Models (BIM) to support construction. This however cannot extend to commissioning the equipment on sites or the digital communication elements. We are looking for a solution that will focus on the digital commissioning elements but also support the wider asset commission.

During design and validation studies for future net-zero transition infrastructure projects, a significant amount of time is spent on completing multiple investigations both desktop studies and physical tests to understand large scale equipment safety, quality assessments and functionality of the system. This adds significant cost and duplication of effort. e.g. compressor design and upgrades.

The UK energy and utility networks heavily rely on automation to operate their networks safely and securely to deliver essential services to the consumer. The resilience of the energy systems, that all industrial customers and consumers rely upon depends on robustly designed, operated, and secured automation systems. These systems include a combination of ‘Operational’ and ‘Information’ technologies (OT and IT respectively) which have been installed over several decades and need modernisations to meet current and future operational, safety and cyber security requirements.

As part of RIIO-2 the TSO, DNOs and GDNs is investing billions in automation system upgrades. Within National Gas Transmission, during RIIO-T2 and T3, all the existing compressor stations will undergo major control, safety, and cyber security systems replacement on a previously unexperienced scale. At National Gas Transmission alone, new automation control system framework partners have been appointed to deliver over £300m works, which is unprecedented within the UK utility industry.

What are we looking for?

This project seeks to deliver a novel technology that helps overcome the key challenges in design validation, automation system delivery and ongoing quality assurance that utilises data and learning from other innovation projects to map current state of facilities. The solution would ideally be closer to implementation – TRL 6-8, but we will consider more challenging options.

A solution to this problem would develop a way to automate verification of the future control systems and their ongoing assurance. This tool could be used to verify that the operational, safety, and cyber security requirements are met during design, well in advance of any intrusive site works taking place.

A solution would be able to support networks to understand all commissioning aspects to a large-scale equipment operation and support real-time understand and decision making to reduce time, resources, cost and improve communication between suppliers, the networks and the operational construction teams commissioning the projects.

A proposed system could use simulation and verification processes to identify and address any potential issues with control systems' operational, safety, and cyber security requirements. The diagnostic system could help understand maintenance and repurposing strategies to understand where repurposing is a better solution than buying new. A digital version of these validation studies would help ensure the design meets the desired outcomes before it goes live, saving time and reducing risks.

In the future, it may be used for ongoing assurance and training to allow for the automated verification of control systems in a simulated environment and to test changes to operations before implementing them.

What are the constraints?

All DNOs operate a design assurance process based on the IGEM/GL/5 framework. This solution seeks to automate the application of this assurance process for control system projects.

This solution aims to offer a solution that all networks can use to solve this problem. The solution must be compatible with current IT infrastructure and be compliant with all regulations and compliance.

Data can be accessed with RFI/TQ requests from each network or through any data that is readily available through the ENA Portal.

Who are the key players?

All Transmission and Network Operators will have this problem. There may be modifications to be made to a solution dependant on internal systems, but this solution should aim to be the base design and framework to enable quick scale-up and utilisation to the industry. The main internal stakeholders will be Asset Design, Control Room, Construction and Strategy teams within each DNO, TSO, and GDN.

Many different people will benefit on top of the key stakeholders mentioned above which include, financial, commercial, suppliers, and operational teams. The end customer, the UK population, would benefit greatly as we foresee significant savings in cost and time that would impact the consumer.

Whilst we are focused on energy system commissioning, we foresee any tool being able to be utilised in any industry or may have already been deployed in a separate industry.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

There are currently no other projects ongoing that supports pre-studies for this problem statement. There are future dependencies on supporting the transition of our network and repurposing our current sites and infrastructure in the most economically and safe approaches. The integration of current information and results from material testing, asset studies, blending infrastructure studies should be high priority. This will enable a realistic modelling and understanding of our current systems versus new plans and understanding of future capabilities.

The future dependencies will be the reliance on changing our technology systems to enable the transition.

What else do you need to know?

Example submission would be:

Phase 1: A success outcome of Phase 1, would be to have a hardware interface, software model for a single site and a trial test

Phase 2: The outcome of the phase is a complete automation verification tool, ready to be used by the network and their system integrator partners.

Download full document here

View presentation slide here

View presentation video here

What is the problem?

When electricity networks are affected by severe weather events this can cause widespread damage that takes multiple days to be restored. Currently few of the vehicles used by staff engaged in restoring supplies are electric vehicles, but as we decarbonise our operations this is likely to increase. With the possibility that batteries for vehicles on site will be required to power lighting, heating etc. then there will be a need for these vehicles to re-charge. However, in a major system emergency local recharging stations may not have power and driving to recharging stations further away would cause significant delays to restoration work and risk vehicle stranding. While we would expect to retain some non-electric vehicles to reduce this risk, what are the options to manage electric fleet recharging in system emergencies? How can we optimise our mix of vehicles, generators, etc. to achieve an acceptable balance of risk and cost? What information and systems are needed to understand the likely requirements? How would the charging requirements for other emergency services need to be taken into account when devising a solution? What are the trade-offs between security of supply for charging infrastructure connected to different networks (Transmission /132kV, EHV, HV) and therefore likelihood of the chargers having a secure supply vs. the distances to access the chargers?

What are we looking for?

We are not necessarily looking for a full fleet charging management system to be delivered, but rather to understand the solutions and/or services could be employed to ensure that restoration staff can continue working and using their vehicles when local EV charging facilities may not be available. We are looking to understand the full range of options (including counterfactuals and scenarios with significant non-electric vehicles) , risks, carbon impacts and costs and the high-level strategies and policies that need to be put in place. We are also looking for a view of how the optimum solution may change over time with the expectation that over time the proportion of the fleet that is electrically powered will change but also that the availability of charging locations capable of rapid and ultra-rapid charging will improve.

What are the constraints?

As there will be a degree of uncertainty associated with the assumed inputs to the analysis, the analysis should be presented as an updateable tool rather than a static report. This should allow recalculation as assumptions are updated and should support modelling multiple scenarios.

Who are the key players?

The Electricity Distribution Network Operators are the main stakeholders in this project, but EV fleets operated by transmission network operators and gas distribution networks will also be affected by widespread or long-lasting power interruptions as well as water and telecoms utilities. Similarly, there will be a need to ensure that where EV charging facilities are limited that other essential services e.g. ambulances, fire engines, police vehicles can continue to operate.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

Previous innovation projects have examined the impact of electric vehicles on the network rather than operation of EV fleets in system emergencies.

Download full document here

View presentation slide here

View presentation video here

What is the problem?

To maintain their above ground and underground pipework assets, all Gas Distribution Networks (GDN) operate substantial fleets of commercial vehicles (primarily vans, but also HGV’s), together with mobile plant and powered equipment. This equipment is usually owned but may also be hired. Presently, there is a complete reliance on hydrocarbon fuels, primarily diesel and to a much smaller extent, petrol, the latter usually for portable (i.e., non-wheeled or tracked) equipment. Both fuel types are usually sourced via the public retail forecourt network.

Similar issues exist for other utility providers that operate underground and overground infrastructure.

Studies have shown that battery-electric technology is not suitable for many of these applications, nor is likely to be in the foreseeable future. Consequently, an alternative is required, to enable the transition to zero emissions to be accelerated. Hydrogen is the only alternative technology that could provide a suitable solution.

GDN’s maintain their infrastructure on two main bases: long-term pipe renewal; and on a breakdown basis where appropriate (‘emergency response’).

The former case requires teams of operatives to be on site for extended periods – typically many days or for several weeks. This basis allows some flexibility of approach.

The latter case is more challenging, as the emergency response team must be able to bring to, and later remove from site, all necessary machinery, powered equipment, and tools on a single-visit basis.

In the case of WWU, two 3.5 tonne vehicles are provided for an emergency response team:

- A van with on-board power; and

- A light tipper with additional secure storage for tools and equipment

The provision of ‘on-board power’ allows full engine power to be available for the purpose of on-site air compression for pneumatic road breaking, rock drilling, ‘moling’ and mains-voltage electricity generation, for pipe fusion, pumping, lighting, and other functions.

Trials have shown that road-breaking via electric and hydraulic power is inefficient – whilst it can get the job done, it may increase the time taken and may increase overall operator exposure to HAVS, which is not acceptable.

What would be the alternatives available to GDN’s and other utility operators?

What are we looking for?

The solution must be operable at scale.

Wales and West Utilities Ltd operates 1300 vans, of which around 700 are directly engaged on site operations, whether replacement or emergency. 450 of the 700 have ‘on-board power’, Other assets used on site include 150+ mini-diggers, 50+ towed compressor/generators, 100 mobile welfare units, 50+ 3t dumpers. Petrol – fuelled powered equipment includes 500+ vibrating trench rammers, 500+ tarmac saws, generators, and water pumps. Electrical equipment includes 500+ butt fusion boxes, floodlighting sets, submersible water pumps.

Other GDN’s (and other utility operators) have similar fleets.

What are the constraints?

For emergency response working, the solution must allow for:

The parent van to:

- Not be captured by Goods Vehicle Operator Licencing legislation; i.e., ≤5 tonnes GVW

- Be zero tailpipe emission.

- Carry a range of tools and equipment including tarmac saw and/or trench rammer.

- Capable of towing a trailer carrying a mini-digger, or other trailers up to 3t.

- Act as an on-site power source for road breaking, rock drilling and ‘moling’ equipment.

- Act as an on-site power source for mains-voltage electricity generation, for pipe fusion, pumping, lighting, and other functions.

- Be capable of recharging multiple batteries for on-site portable equipment, where appropriate

- Be capable of being refuelled on site, if possible

- Provide heating for the cab for personnel and in the load space (for clothes drying) when stationary on site.

The light tipper to:

- Not be captured by Goods Vehicle Operator Licencing legislation; i.e., ≤5 tonnes GVW

- Be zero tailpipe emission.

- Capable of towing a trailer carrying a mini-digger, or other trailers up to 3t.

- Be capable of carrying a granular load (~ 0.75t) discharged by tipping to the rear

- Be capable of carrying other loads, including but lot limited to Sign, Lights and Guarding (SLG) equipment

- Offer secure storage for vibrating rammer, road breaker, rock drill and other tools and equipment

- Be capable of recharging multiple batteries for on-site portable equipment, where appropriate.

The mini-digger to:

- Be zero tailpipe emission.

- Offer a digging performance not less than that of a JCB 16C-1.

- Incorporate a range of 3 detachable bucket types.

- Operate and incorporate a detachable hydraulic breaker to minimise the need for excavation by hand.

- Have an operating duration equivalent to diesel.

- Be capable of being refuelled/recharged on site, or overnight if necessary.

- Preferably be capable of being carried on an existing WWU mini-digger trailer.

Road breaking, rock drilling and ‘moling’ equipment to:

- Be intrinsically safe, e.g., via on-site air compression.

- Operable on a continuous basis for an extended period, e.g., not less than 8 hours.

- In the case of road breaking and rock drilling equipment, minimise the risk of HAVS

- Ideally, the same equipment types as those used currently.

Powered tarmac cutting equipment to:

- Be sufficiently powerful to cut road and pavement surfaces quickly and effectively to the required depth/s and with operating duration equivalent to petrol (or where the energy source may be quickly exchanged, analogous to refuelling petrol from a can). HAVS not to exceed, and preferably better than, existing equipment.

Powered trench ramming equipment to:

- Deliver sufficient sustained blow energy to enable base layer reinstatement to be compacted with the same performance as for petrol and with an equivalent operating duration (or where the energy source may be quickly exchanged, analogous to refuelling petrol from a can). HAVS not to exceed, and preferably better than, existing equipment.

For planned replacement working, the solution must allow for:

All the above requirements and:

The on-site welfare facility to:

- Be secured from attack and vandalism when unattended

- Be capable of being towed on the highway by a vehicle ≤5 t

- Provide a secure messing facility for up to 6 people with basic food heating, hand/utensil washing, water boiling and lighting and space heating facilities

- Provide a toilet facility with hand washing and effluent retention

- Provide a clothes-drying capability

- Be zero-emissions

- Be self-powered, or powered from an external on-site source

- Maximise the opportunity for solar power.

The on-site power generation capability to:

- Be capable of movement around the site, e.g., being towed by a vehicle ≤5 t

- Be capable of recharging multiple batteries for on-site portable equipment, where appropriate

- Be capable of powering the on-site welfare unit/s where appropriate

- Be capable of providing air compression for road breaking, rock drilling and ‘moling’ equipment.

- Be capable of generating and storing mains-voltage electricity, for pipe fusion, pumping, lighting, and other functions.

- Be capable of being refuelled on site.

The 3t dumper to:

- Be capable of carrying a granular load of up to 3t, discharged by tipping to the front

- Be operable by the holder of a Category B driving entitlement

- Be as manoeuvrable as practicable

- Be road registered as a Works Truck

- Be zero tailpipe emission.

- Be capable of being refuelled on site.

The on-site refuelling facility to:

- Be capable of carriage on a vehicle ≤5 t (preferably) and/or a trailer of GVW 3t

- Be capable of refuelling all the asset types above where on-site refuelling is required to enable a significantly increased operational duration

- Be certified for use under ADR where appropriate

- Be capable of rapid replenishment at a suitable facility.

For all assets:

- The solution/s must be extensively tested to prove durability and performance.

- To be available for prototype testing within 24 and preferably within 12 months

- Available for extended testing in quantity within 24 months

- Available for widespread adoption within 48 months.

Who are the key players?

Key stakeholders are:

Gas engineers and operatives – in WWU, the ‘Build and Replace’ workstream.

Solutions are required from vehicle manufacturers, mobile plant manufacturers, equipment manufacturers, plant hire companies.

The target market is utility and construction/civil engineering organisations.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

This work is linked to the development of:

- Battery-electric vehicles

- Hydrogen-fuelled vehicles

- Battery-electric or hydrogen-fuelled mobile plant

- Hydrogen-fuelled and solar on-site generation

- Battery-powered portable equipment

WWU is shortly to trial a hydrogen-fuelled van.

Download full document here

View presentation slide here

View presentation video here

Flexibility and Forecasting

Developing and testing market-based solutions to increase the flexibility and efficiency of the energy system; accelerating the adoption of low carbon solutions.

What is the problem?

When it comes to forecasting, there are a range of input variables that are used in order to produce a result. The more detailed the inputs, the likelihood of a more accurate output will be higher. When carrying out forecasting, previous load data and weather data are currently used in order to produce forecasts that will then be used to make strategic decisions relating to network investment.

One thing that isn’t considered in the input variables is current market data and customer behaviour. For example, would it be possible to take pricing data from the wider market in order to understand what assets will (not) likely run.

What are we looking for?

Furthering on from the above, DNOs would be interested in finding out what additional market data would be useful to a DNO and in what capacity is it useful? This would then be used to carry out more robust forecasting and network planning.

Therefore, we would like to see some desktop work and thought process into finding and trialling the differing range of datasets that could be used into our planning and forecasting process.

What are the constraints?

The solution must adhere to our current forecasting and planning arrangements

The solution must be able to quantify the benefit of included differing data sets

Who are the key players?

- Flexibility Service Providers

- Energy Suppliers

- Economic Consultants

- DNOs

- ESO

- Asset Owners

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

N/A

What else do you need to know?

N/A

Download full document here

View presentation slide here

View presentation video here

What is the problem?

Throughout the energy transition, there will be more and more assets with automated capability that can and will follow market price signals. This would traditionally be at times when there is excess network headroom, during the early hours of the night with EV charging, for example, but at what point would this become a problem and what would the mitigations be to negate this potential peak shifting.

The key is understanding the potential scale for this. Currently it is not an issue, but with the increasing uptake of LCTs, there may become a point when this does become a problem.

What are we looking for?

We would like to understand through a potential feasibility and thought leadership piece, the possibility and potential effect of the aforementioned problem. We would like to see potential mitigations that could be put in place in order to spread load over a longer period of time. Questions to be considered include: Will weaker price signals be introduced in the process? Will the natural dynamics of the wholesale market smooth it out? Are there any other ways that this could be mitigated and if introduced does it completely negate peak shifting during these periods.

What are the constraints?

- The solution must consider a range of assets that could potentially impact the network

- The solution must consider current and potential future market structures

Who are the key players?

- Flexibility Service Providers

- Energy Suppliers

- Economic Consultants

- DNOs

- Asset Owners

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

N/A

What else do you need to know?

The potential project would likely need multiple stakeholders involved in order to achieve the desired output.

Download full document here

View presentation slide here

View presentation video here

Maximising Use of Existing Infrastructure

Making the most of the networks' current infrastructure, to reduce the consumer cost and environmental impact associated with new construction projects.

What is the problem?

Switchgear erosion due to proximity to the sea - we have found that electrical assets, particularly within the distribution network, such as switchgear, Pole Top Equipment and both pole and ground mounded transformers seem to be eroding quicker in coastal areas due to high salt content in the air from the sea, and degrading at a much faster rate than their inland counterparts. This issue is causing significant corrosion particularly to the bodywork and brackets of pole mounted transformers and some switchgear equipment.

What are we looking for?

We are looking for any way to reduce the rate of degradation and impact that the high salt content has on the speed of corrosion on these assets located by the sea. Is there a way to extend the lifetime of switchgear, by using an external coating? Or is there a specific type of switchgear less susceptible to salt? etc.

What are the constraints?

The solution must be in compliance with both company and industry regulations and standards.

Who are the key players?

Utilities who have assets located by the sea would benefit from this project however predominantly Electricity Distribution Network Operators would be the main stakeholders in this project.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

May relate to 'Coastal Flooding and Erosion' NGET Call for Innovation. It will provide a modelling solution i.e. monitoring risk and data collection, rather than provide a saline-proof coating etc.

What else do you need to know? / Other Information

Would be interested to see how other industries such as offshore oil and gas for example could help.

Download full document here

What is the problem?

Extending asset life is critical to reducing the cost of the system and making more money available for investment in system expansion and reinforcement. As the asset ages, we need smarter ways of monitoring asset conditions. The current practice is largely one in which assets are inspected by engineers visiting the sites, including substations, transmission towers and distribution poles. Over the last decade or so, there have been many efforts to develop smarter ways of monitoring assets, predicting asset life and developing intelligent maintenance plans. Many of these projects are documented on the ENA Smarter Network Portal (ENA Innovation Portal (energynetworks.org)). Examples include:

- Condition Monitoring of Power Assets: Condition Monitoring of Power Assets (COMPASS) | ENA Innovation Portal (energynetworks.org)

- Network Reliability Asset Replacement Decision Support Tool. Network Reliability Asset Replacement Decision Support Tool | ENA Innovation Portal (energynetworks.org)

- Understand and Improving Condition, Performance, and Life Expectancy of Substation Assets. Understand and Improving Condition, Performance, and Life Expectancy of Substation Assets | ENA Innovation Portal (energynetworks.org)

- Smart Asset Management - Smartlife Workgroup. Smart Asset Management - Smartlife Workgroup | ENA Innovation Portal (energynetworks.org)

There are many more examples of efforts to make inspection, repair and maintenance (IRM) smarter and more efficient. However, it cannot be said that smart asset management is yet business and usual (BAU). One of the potential reasons for slow adoption is that there is a lack of coordinated efforts to create holistic systems for smarter monitoring and management. There is also the barrier of cost to retrofit existing assets. There are a number of challenges to overcome before a holistic solution can be created:

- Deploying remote monitoring that is both reliable and cost-effective

- Ensuring that accurate data is easily accessible whilst also ensuring cyber-security

- Managing large amounts of data ensuring accuracy and accessibility

- Developing tools that can assist in interpreting large amounts of data, this might include machine learning and artificial intelligence.

- Using current and past data to forecast asset risks and faults and automatically optimise asset maintenance.

What are we looking for?

We are interested in understanding innovations that could coordinate and leverage previous niche innovations to develop a holistic approach to proactive asset management that could identify assets at risk and identify assets where working life could be extended. We are also interested in developing strategies that reduce the cost of holistic asset inspection repair and maintenance. This could include:

- Moving already developed technologies to Business as Usual, including qualification of systems and reduction of cost

- Developing methods and tools to coordinate and integrate disparate data

- New methods (not already considered) to solve more challenging problems, for example inspection of ACCC overhead cables

- New designs and standardisation of equipment that facilitate remote monitoring and data gathering.

Areas of more specific interest would be:

- Small scale sampling on targeted asset types or groups, to support in-depth statistical analysis which may lead onto inform machine learning

- Widening the baselining activities associated with aging assets, documenting and holding metadata improvements, exploring different means of data analytics to find anomalies

- Progressing traditional near-to-real time monitoring tools to ‘edge process’, by means of pushing the hunting patterns to the field locations (and therefore the monitor is mainly silent).

What are the constraints?

Innovators should avoid pitching niche innovations, where innovation money has already been spent trying to solve the problem. Innovators should be able to demonstrate that they have knowledge of previous innovation projects. Any pitch should have a clear road map to Business as Usual. We particularly encourage thinking that would allow coordination, storage and integration of very large datasets. It should be understood that each network has a data management and open data plan, and so any proposal should be aware of networks' pre-existing plans for digitalisation. Innovators that are able to demonstrate proactive engagement with the network's existing plans would be an advantage. It is important that innovations can integrate with existing and planned data management systems.

Who are the key players?

The key stakeholders are:

- Networks, project engineering and asset operations teams

- Network data custodians and analysis teams

- Third party niche solution providers that already provide an asset monitoring solution.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

Innovators should be aware of previous work in this area of innovation, much of which can be found documented on the ENA Smarter Networks Portal ENA Innovation Portal (energynetworks.org).

Download full document here

View presentation slide here

View presentation video here

What is the problem?

Substations susceptive to flooding have been identified following ETR138 review and flood defences installed as a flood protection measure. During a flood event it can be too dangerous for field staff to access a site to monitor rising flood levels and in some cases flood defences can be breached leading to uncontrolled shutdowns resulting in supply interruptions and lengthy restoration times. Often switching operations in surrounding to restore supplies are difficult due to flood waters covering the local area.

If water levels could safely be monitored remotely the risk of uncontrolled shutdowns and risks to field staff would be eliminated. Rising water and high water alarms would allow automatic disconnection / sequence switching schemes to be utilised to reduce equipment damage and supply interruptions. These schemes would consider local areas and remote switching point’s vulnerabilities to rising flood water and identify restoration plans prior to a flood event.

What are we looking for?

Means to monitor water levels in electricity distribution substations during flooding events remotely and alarms for automatic disconnection/sequence switching.

What are the constraints?

- Risk analysis for automatic switching to take place

- Integration with current SCADA systems

- Current flood response policy

Who are the key players?

DNOs, Environment Agency, Electricity transmission networks

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

Relatively simple alarms systems have been used before for flood indication but further advances to technology are required.

Download full document here

View presentation slide here

View presentation video here

What is the problem?

To understand the capacity of the existing network and the impact of future load growth we model the network. The accuracy of the results from power flow analysis will reflect the accuracy of the underlying network model. One of the areas where network models lack data is phase connectivity.

LV networks are at risk of network unbalance as neither service cable or phase connectivity was captured at the time of installation for large areas of network. The connection of increasing volumes of low carbon technologies such as heat pumps, EV chargers and domestic PV has the potential to worsen the unbalance between phases increasing losses and reducing the effective capacity of the network. The SMITN project has proposed mechanisms to identify the phase connectivity for LV connected customers, however missing phase information is also an issue with our HV network model where the connectivity for single phase transformers is not always known.

Recently there have been improvements to network visibility with monitoring equipment being installed at distribution transformers and additional information being available from smart meters. At the same time there has been an increase in imagery available from satellites, aerial photography and other sources.

Are there new methods that can be used to backfill missing information about HV network connectivity?

What are we looking for?

We are looking for solutions that can be applied without the need for on-site surveys. Ideally these can operate with low levels of monitoring coverage on the HV network.

What are the constraints?

The solution must be cost effective to operate, and thus needs to be able to process existing data at a lower cost than sending staff to site to establish phase data.

Who are the key players?

The key stakeholders are electricity Distribution Network Operators and in particular teams associated with data and mapping. The main beneficiaries will be customers applying for new or altered connections, but the broader customer base will benefit from lower network costs that would result from making better use of existing network capacity by reducing phase unbalance.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

This builds on the work carried out for LV phase connectivity for SMITN. https://smarter.energynetworks.org/projects/nia_wpd_066/

What else do you need to know?

N/A

Download full document here

View presentation slide here

View presentation video here

What is the problem?

Link Box Fault Finding Devices – Link boxes, also commonly referred to as Path Boxes as they are in the footpath, due to their design and size present a number of different challenges to DNO’s, for instance flooding is more prevalent with link boxes than in pillars. The issue we are interested in currently is that of fault-finding devices within assets such as link/path boxes and small LV Pillars. The HV network utilises earth fault indicators attached to the ring main unit in secondary subs to help fault location, and we do have many different fault indicating devices at our disposal, however typical TP units and fault information devices such as the Kelvatek Bidoyng can’t fit inside these boxes.

What are we looking for?

We are looking for a fault-finding device that is small enough that it can be fitted inside the link box (2- and 4-way link box) or pillar, and that can indicate if fault energy has been seen on individual section. This device should ideally indicate the presence of fault energy to the resources on site and ultimately can help reduce CI/CML (customer interruptions/customer minutes lost).

What are the constraints?

The solution must be in compliance with both company and industry regulations and standards.

Who are the key players?

Utilities, predominantly Electricity Distribution Network Operators would be the main stakeholders in this project and receive the most benefit.

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

N/A

What else do you need to know?

N/A

Download full document here

What is the problem?

The existing transmission network is increasingly curtailed due to a limited amount of electrical energy that can be transferred by existing circuits. The cost of curtailment is expected to peak between £1-2.5bn a year by 2025. The majority of curtailed generation from renewable sources is due to positioning at network extremities combined with variable generation.

The current practice relies on long-standing ratings of OHL and substations. SSEN-T are currently working on a strategy for: Active Network Management, Dynamic line rating and revising the current static line rating methodology.

What are we looking for?

We are looking for ideas related to the holistic assessment of integrated system capacity and potential for transmitting more power -

- If we increase the rating of lines, what is the impact on connected equipment?

- Cost-effective methods for uprating existing equipment

- How do modify the substations and switchgear to allow more power to be transmitted?

- New designs for overhead lines

- How do we validate novel materials overhead lines?

- Novel ideas that contribute to our existing projects in DLR, ANM and revised line rating.

What are the constraints?

We already have ongoing projects related to -

- Dynamic Line Rating

- Revised line rating methodology (static line rating)

- Active Network Management to maximise utilisation and reduce spare capacity.

Proposals should be aware of existing projects and should demonstrate how the idea can complement existing projects and build on previous work. We are interested in proposals that remove barriers that prevent previous solutions from becoming BAU (please see below).

Who are the key players?

- Transmission network operator

- ESO/FSO

- Equipment manufacturers

- Ofgem

- Regulation and codes

Does this problem statement build on existing or anticipated infrastructure, policy decisions, or previous innovation projects?

Previous projects:

- Retrofit Insulated Cross Arms (RICA): By replacing metallic cross arms with insulated cross arms (ICA) the Retrofit ICAs (RICAs) solution through increased clearance to earth will allow licensees to upgrade the voltage rating of existing 275kV towers to operate at 400kV. Retrofit Insulated Cross Arms (RICA) | ENA Innovation Portal (energynetworks.org) also: Composite Cross-Arms Study | ENA Innovation Portal (energynetworks.org) also: 132kV Insulated Composite Crossarm Trial | ENA Innovation Portal (energynetworks.org), also Insulated Composite Crossarm | ENA Innovation Portal (energynetworks.org); also Composite Cross Arms Study | ENA Innovation Portal (energynetworks.org)

- Overhead Line Sagging Monitoring Using 5G Signals: All overhead lines in the GB transmission network must maintain statutory clearances to ground. To maintain these clearances the line; sag needs to be monitored. Also, if the line sag can be monitored easily and with great frequency (dynamically), it is possible to provide valuable inputs to the dynamic thermal rating of the overhead line. Current methods use either sensors installed on the line to directly measure temperature/sag or weather stations nearby to indirectly calculate temperature/sag. This project aims to design a new method by exploiting the fifth generation (5G) cellular signals to directly monitor and measure the line sagging but without sensor installation on the line. Overhead Line Sagging Monitoring Using 5G Signals | ENA Innovation Portal (energynetworks.org)

- Hydrogen Production for Thermal Electricity Constraints Management: Thermal constraints are forecast to cost consumers between £500m and £3b a year between now and 2030, owing to an increase in renewable generation and a lack of capacity on the transmission system to transfer power from where it generated to where it is used. Hydrogen Production for Thermal Electricity Constraints Management | ENA Innovation Portal (energynetworks.org)

- Analysis of the Thermal Influence of Cable Surroundings (AnTICs): The power flow capacity of high voltage cables is limited by the heat dissipation ability of their immediate surrounding environment. However, despite the large number of projects built in the past, the surrounding environment's thermal properties are often poorly understood. Typical assumptions are often excessively conservative, which may have led to excessively large cables costing extra. This project proposes to use expert geological and oceanographic analysis to build bespoke numerical models of cable systems, which can then be validated using Distributed Temperature Sensing (DTS) data. Current design approaches can be tested and establish if the level of conservatism in cable system design can be safely reduced. This project would also propose new methods to rate and size cable systems that can best inform business decisions. Analysis of the Thermal Influence of Cable Surroundings (AnTICs) | ENA Innovation Portal (energynetworks.org)

- SCOHL: This project aims to assess the potential for implementing novel high-temperature superconductor (HTS) technology on National Grid's overhead line (OHL) assets. Meeting Net Zero goals requires £21.7 billion for 94 onshore network reinforcement projects by 2030, with additional build-out by 2050 (NOA 2021/22 Refresh). However, the required pace of network expansion is unprecedented and regulatory processes and public resistance can slow deployment, especially for new OHL routes which have high visual impact. SCOHL | ENA Innovation Portal (energynetworks.org)

- Cost effective removal of conductor crossing clearance constraints: The scope of this project is to develop the installation methodology for raising the height of the bottom phase conductor on a tower by installing semi tension insulators on two consecutive towers in order to reach an overall increase in overhang clearance by 5m. This methodology will then be tested by raising the overall height by 5m of two consecutive towers over a river crossing. Cost effective removal of conductor crossing clearance constraints | ENA Innovation Portal (energynetworks.org)

- UltraWire: This project is aimed at developing a copper nanocarbon composite with significantly improved overall properties, including electrical, thermal and mechanical performances compared with bulk copper. The proposal also aims to develop production process that will be scalable to large volume manufacture. UltraWire | ENA Innovation Portal (energynetworks.org)

- Unlocking Transmission Transfer Capacity: It is proposed to investigate the use of Energy Storage systems to economically unlock the inherent transmission network capacity. Strategic locating and sizing of storage resources will allow the network operators to load the network to a synthetic N-0 capacity, and when necessary to utilise the strategic storage resources to absorb/inject power post contingencies up until a system re-dispatch is affected. Unlocking Transmission Transfer Capacity | ENA Innovation Portal (energynetworks.org)

- Increasing Transmission Boundary Power Flows using an Active Power Control Unit: This project proposes to assess the performance of a novel power electronic asset called the Active Power Control Unit (APCU). The APCU is a technology based on power electronics that can control active and reactive power flows in power lines both at transmission and distribution levels. The ability to control active and reactive power, provide the APCU with the ability to utilise existing capacity within the network. https://smarter.energynetworks.org/projects/nia_ngto023/

- Flexible rating options for DC operation: Modelling the complex interactions of thermal and electrical parameters is essential if National Grid is to make a thorough assessment of tenders for HVDC cable schemes. The modelling of transient thermal conditions and the behaviour of the cable insulation under reversals of power flow will provide guidance for the development of dynamic rating algorithms and operational regimes suitable for high power HVDC cable circuits. The thermal and electrical models will be constructed in such a way that the outcomes of planned R&D work on pressure transients and partial discharge ageing can readily be incorporated at a later date. Flexible rating options for DC operation | ENA Innovation Portal (energynetworks.org)

- Advanced Line Rating Analysis (ALiRA): Current overhead line (OHL) ratings are applied on a seasonal basis and do not consider the geographical location of the assets and associated variances in meteorological conditions. As such, line ratings may be unnecessarily constrained, limiting power flows and prompting unnecessary investment for load related upgrades. https://smarter.energynetworks.org/projects/nia_ngto014/

- Enhanced Weather Modelling for Dynamic Line rating (DLR): This project aims to establish the spare thermal capacity in overhead lines that exists as a result of the actual weather parameters compared to seasonal values, and forecast the capacity that will be available ahead of real-time. As such, operational decisions will be able to be made which will reduce the cost of operating the system and potentially avoid or defer reinforcement works following the connection of new low carbon generation. Enhanced Weather Modelling for Dynamic Line rating (DLR) | ENA Innovation Portal (energynetworks.org)

- Dynamic Line Rating CAT1 (SSEN-T): To install a CAT-1 Transmission Line Monitoring system on a SHE Transmission line and demonstrate whether it can enable dynamic line rating resulting in safe and cost-effective line operation close to its thermal rating. Dynamic Line Rating CAT1 | ENA Innovation Portal (energynetworks.org)

- Dynamic Ratings for improved Operational Performance (DROP): This issue is to improve on providing a concise cable rating sheet as part of the CUP package which can be readily used by Network Operations. While this approach works well where the level of load to be transferred is known in advance, it provides for only a limited number of rating combinations based on a series of assumptions about the cable system thermal environment. Given the increasing variability of the UK climate, coupled with the trend towards higher generation of electrical energy from renewable sources, this may not always lead to the best utilisation of a cable asset as its true power transfer capability over periods of 24 hours or less may be under-estimated through this traditional approach. Dynamic Ratings for improved Operational Performance (DROP) | ENA Innovation Portal (energynetworks.org)

- New Suite of Transmission Structures (SSEN-T): The intention of this project is to leverage innovations (for example: ICAs and low-sag conductors) to design a new suite of transmission structures to exploit fully their potential. https://smarter.energynetworks.org/projects/nia_shet_0010/

- The Role for Hydrogen as an Electricity System Asset (NGESO): There is a need to understand how the development of hydrogen markets will interact with the electricity system, and how targeted hydrogen investment can more effectively support the electricity system. The Role for Hydrogen as an Electricity System Asset | ENA Innovation Portal (energynetworks.org)

- Implementation of Real-Time Thermal Ratings: The scope of this project is to implement a dynamic real-time thermal rating system for overhead lines that gives the control room operators greater visibility of the actual thermal operating status of their network. https://smarter.energynetworks.org/projects/spt1001/